🧨 AI Bubble Watch: $100B Loops, 🤖 China’s Cheap Bots Surge, 🍏 Apple Rethinks Wearables

AI chip money recycles through Nvidia, humanoid robot prices drop 60%, and Apple ditches headsets for wearables

✨ GenAI Lab is coming to Brisbane

I’m helping bring GenAI Lab’s first Brisbane event to life on Thu 30 Oct at The Precinct. A practical evening on how humans and AI co-create, with real case studies, clear frameworks, and Q&A.

On stage

Emma Barbato: AI influencer in the wild and what audiences buy

Jamie van Leeuwen: creative production at speed with standards

Gareth Rydon: how to brief and control agents for real outcomes

📅 When: Thu 30 Oct

🕕 Time: 5:30 pm for a 6:00 pm start

📍 Where: The Precinct, Level 2, 315 Brunswick St, Fortitude Valley QLD 4006

🎟️ Tickets: https://events.humanitix.com/genai-powered-creative-stack

🎵 Podcast

Don’t feel like reading? Listen to it instead.

By the way, if you like the podcast. Please let me know (20 seconds).

📰 Latest News

$100B In, $300B Out: OpenAI’s Infinite Money Glitch

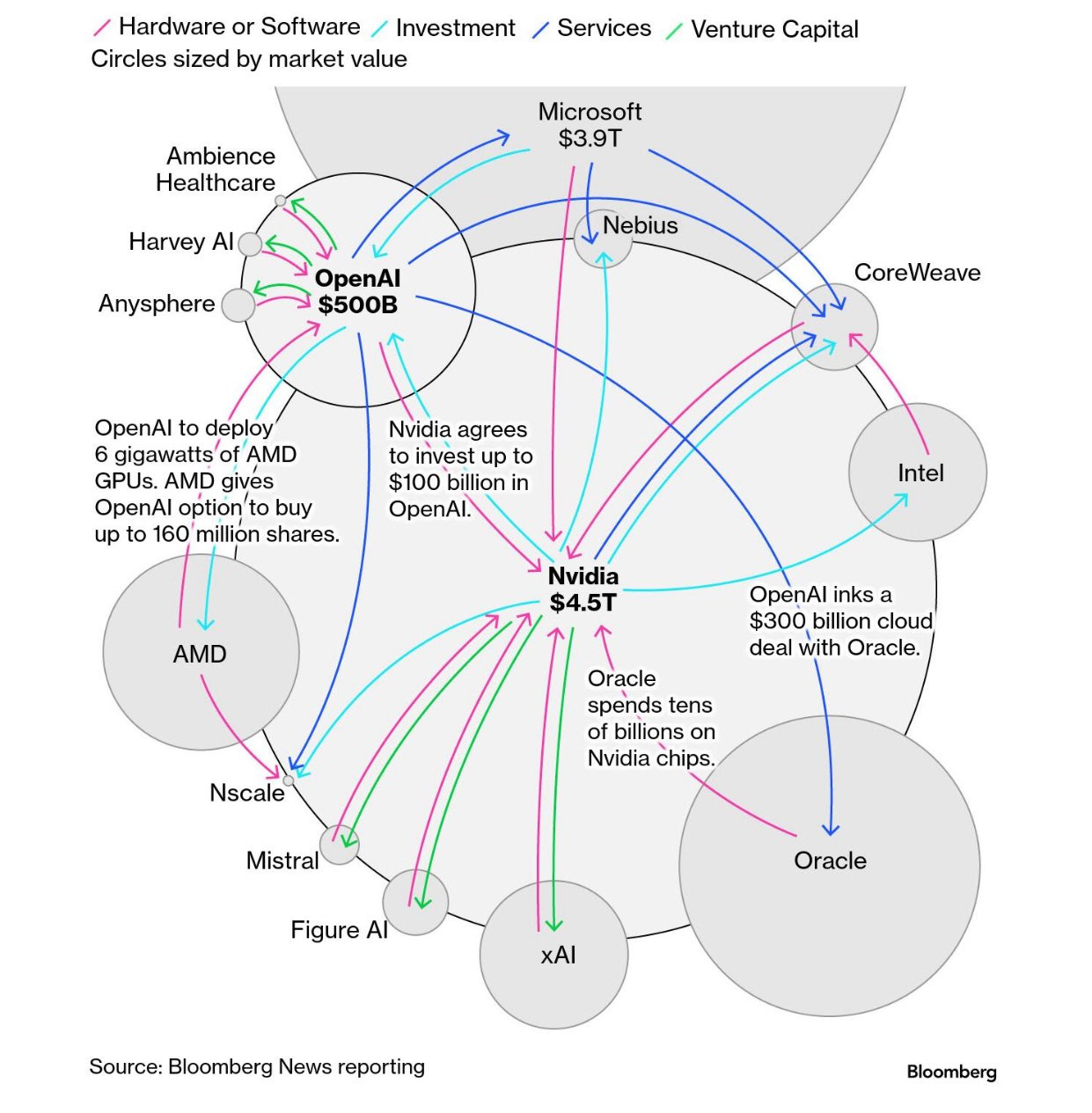

AI chip funding is turning into a loop. Nvidia will invest up to $100 billion in OpenAI as OpenAI buys 10 gigawatts of Nvidia systems. OpenAI also struck a multi-year deal with AMD to deploy 6 gigawatts of compute and received a warrant to buy up to 160 million AMD shares. To feed all that capacity, OpenAI agreed to purchase about $300 billion of Oracle cloud over roughly five years, while Microsoft signed a $17.4 billion GPU-capacity deal with Nebius. The same pattern shows up elsewhere: xAI is raising equity and debt through a vehicle that buys Nvidia chips and rents them back.

Why it Matters:

This is vendor financing at scale. Money flows from chipmakers to AI labs and back to chip orders, which secures supply and market share but raises bubble and competition concerns. The real choke point is not cash but power and data centres: Oracle’s OpenAI contract alone implies about 4.5 gigawatts, and banks say energy and build-outs are now the limiters. Expect tighter disclosure and antitrust scrutiny of related-party deals, and more prepayment or warrant structures that trade future equity for guaranteed compute.

1 in 10 Americans Use Chatbots for News, Under 1% Prefer Them

About 1 in 10 U.S. adults get news from AI chatbots often or sometimes, with another 16% doing so rarely, and fewer than 1% preferring chatbots to other sources. Most adults never use chatbots for news. Younger people use them more, yet many users say it is hard to tell what is true and about half report seeing inaccurate items at least sometimes. On search, AI summaries reduce link clicks and users almost never click the cited sources.

Why it Matters:

Adoption exists but is still small and trust is fragile. Media trust in the U.S. is at a record low, so sloppy AI outputs will deepen scepticism. For publishers and product teams the job is clear: label AI use, show sources by default, make tap-through to originals effortless, and audit for quality. For newsrooms, keep humans in the loop and tighten AI policies to protect accuracy and accountability.

42.9% Lift Across 1,275 Formulations: Lab-Robot Finds Better Mixes

Duke engineers built TuNa-AI, an AI plus lab-robot platform that designs and tunes drug-delivery nanoparticles. It rapidly searches recipe ingredients and ratios, boosting successful particle formation by 42.9 percent across 1,275 formulations. In tests, it improved encapsulation of the leukaemia drug venetoclax and cut a potentially risky excipient by 75 percent in a trametinib formulation while keeping efficacy and improving biodistribution in mice. This is research-stage work with no clinical availability yet.

Why it Matters:

Faster, smarter formulation could help hard-to-deliver drugs reach patients with lower doses and fewer side effects, and gives pharma a repeatable way to tailor carriers to each therapy. It does not steer particles inside the body, and tumour-site delivery remains a known bottleneck, so the next hurdles are animal studies at scale, GMP manufacturing, and clinical trials. The work also fits a broader move to use AI to design smarter nanocarriers for targeted therapies.

Apple Takes Direct Aim at Meta’s Ray-Bans

Apple has paused work on the next Vision Pro and is putting its effort into AI smart glasses. The first version will likely pair with an iPhone and may not include a built-in display, with a display model planned later. The target is clear, compete with Meta’s Ray-Ban glasses using voice first controls, Apple silicon, and Apple Intelligence, with heavier tasks handled by Private Cloud Compute.

Why it matters:

Apple is shifting from an expensive niche headset to everyday eyewear people might actually wear. Comfort, battery life, and looking normal beat flashy mixed reality here. Starting simple keeps cost and risk down, then Apple can add displays as the tech improves. Strong privacy by design could be Apple’s edge over Meta. If Apple nails hands-free capture, translation, and timely prompts, smart glasses could move from novelty to daily habit.

OpenAI’s Wearable Device Falters

OpenAI’s device with Jony Ive is delayed. Reports say the team is stuck on three basics: privacy rules for an always-listening gadget, a clear “personality” for the assistant, and enough compute to run it well. Sam Altman has warned not to expect a launch any time soon, with timelines drifting past 2026. Ive and Altman now talk about a “family of devices” aimed at calm, human-centred use rather than phone-style screens.

Why it Matters:

The pause gives rivals more oxygen. Apple has shifted resources to AI glasses (story above). Meta’s Ray-Ban line is growing fast, with sales in the millions and new display models selling out. By contrast, early AI gadgets like Humane’s Pin stumbled, showing how hard the category is. If OpenAI cannot solve privacy, tone, and compute at once, it risks missing the window as glasses and lightweight wearables set the norm.

China’s 2025 Humanoid Surge: 60 per cent cheaper to ~A$8,500, half of global output

China is pulling ahead in humanoid robots. Beijing set a goal for mass production by 2025 and local makers are shifting from demos to factory lines. Industry watchers expect China to make around half of global humanoid units this year. Prices are falling fast: Unitree cut its entry model from ¥99,000 for the 2024 G1 to ¥39,900 for the 2025 R1, roughly A$21,100 down to A$8,500, a drop of about 60 percent. The state is also backing adoption with subsidies and public procurement to seed pilots in manufacturing and services.

Why it Matters:

Cheaper robots move from showcases into day-to-day work in factories, logistics and care. China’s scale will set parts standards and training norms. For rivals, the edge shifts to software quality, integration, safety and trust. Expect tighter rules on workplace safety and data use as deployments spread. For buyers in Australia, remember landed cost will be higher than list prices once GST, shipping and duties are added.